X

Choose your trading platfom

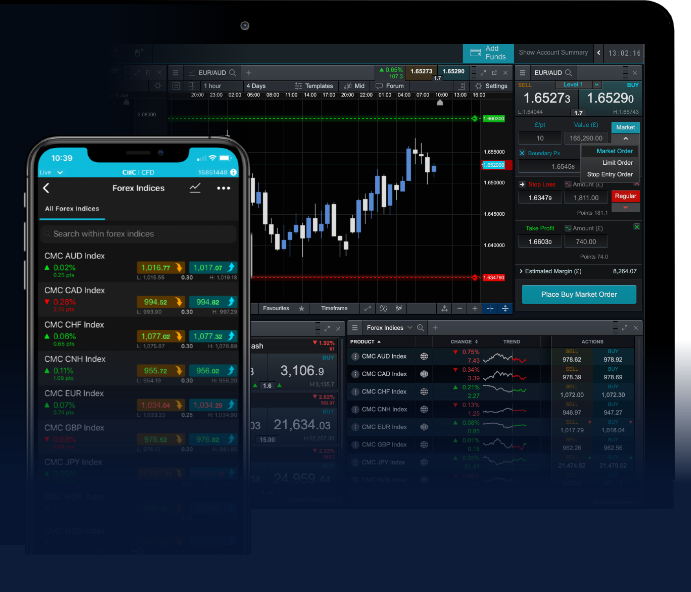

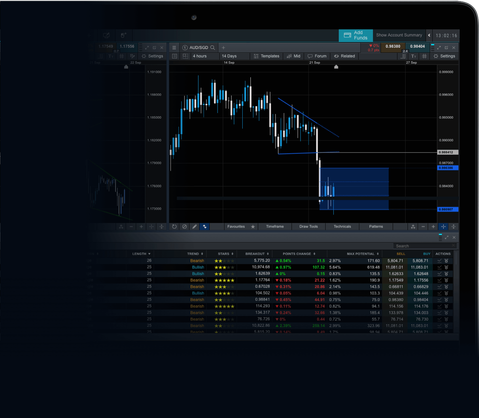

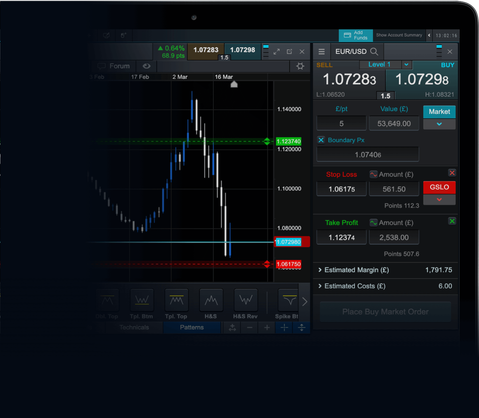

Web-Based Platform (NGEN)

Our Next Generation trading platform combines institutional-grade features and security, with lightning-fast execution and best-in-class insight and analysis.

Trade contracts for difference (CFDs) on over 12,000+ products including FX Pairs, Indices, Commodities, Shares and Treasuries.

CFD account

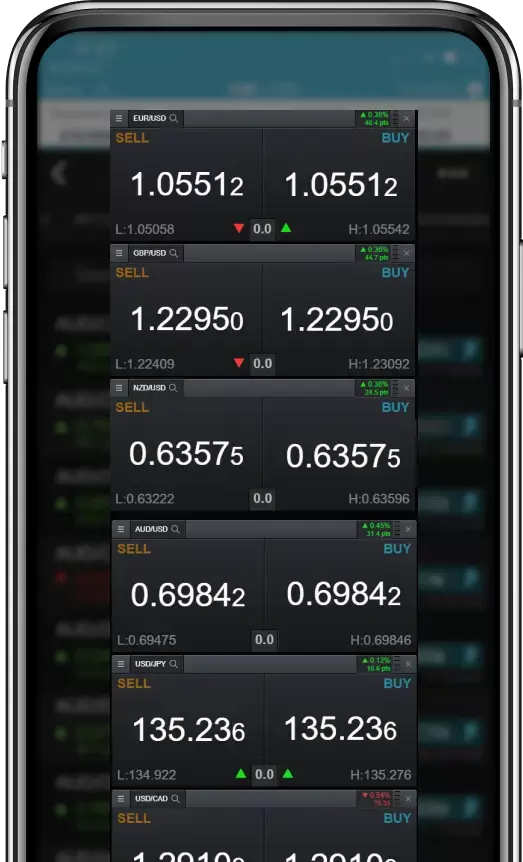

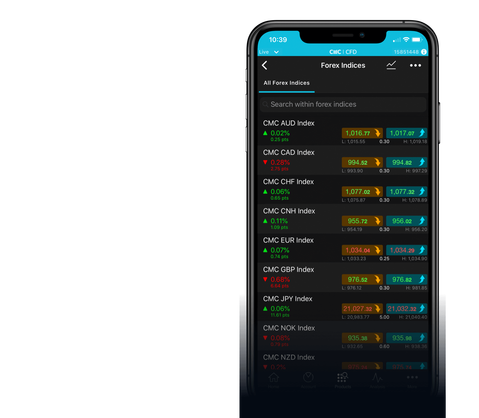

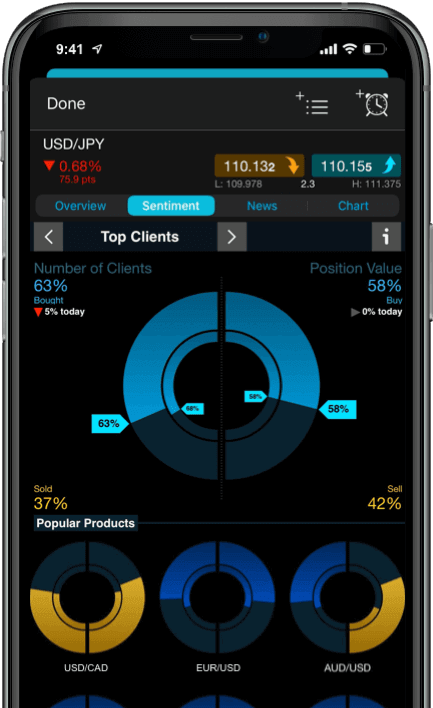

MetaTrader 4 Platform (MT4)

Competitive spreads on 200+ instruments including FX pairs, indices and commodities

Fast, automated execution, with tier-one market liquidity

Advanced charting tools, EA's and algorithmic trading

MT4 account